Capital Loans

Needing a hand financial is a pretty common small business issue. If you’re like most Americans, 2008 hit your credit harder than ever and most banks aren’t eager to hand over a traditional “small business loan”, despite your businesses success.

No worries- Most e-commerce platforms now offer their own lending called a “Capital Loan”.

Don’t let this scare you. We are going to thoroughly weigh 2 options below and get you geared up and informed, ready to grow your business. I’ve got you!

The only two capital loans we at BHUB consider logically choices would be Paypal Working Capital and Shopify Capital Loan. We will run through each one of them (which is similarly structured) and help you weigh your options. In our opinion, there is a clear front runner, despite what we’ve heard from others. A lot of legwork was put into this investigation, and we take your finances serious. No one else is looking out for the small business. Regardless, it’s ultimately up to you when choosing a lender and terms.

Structure

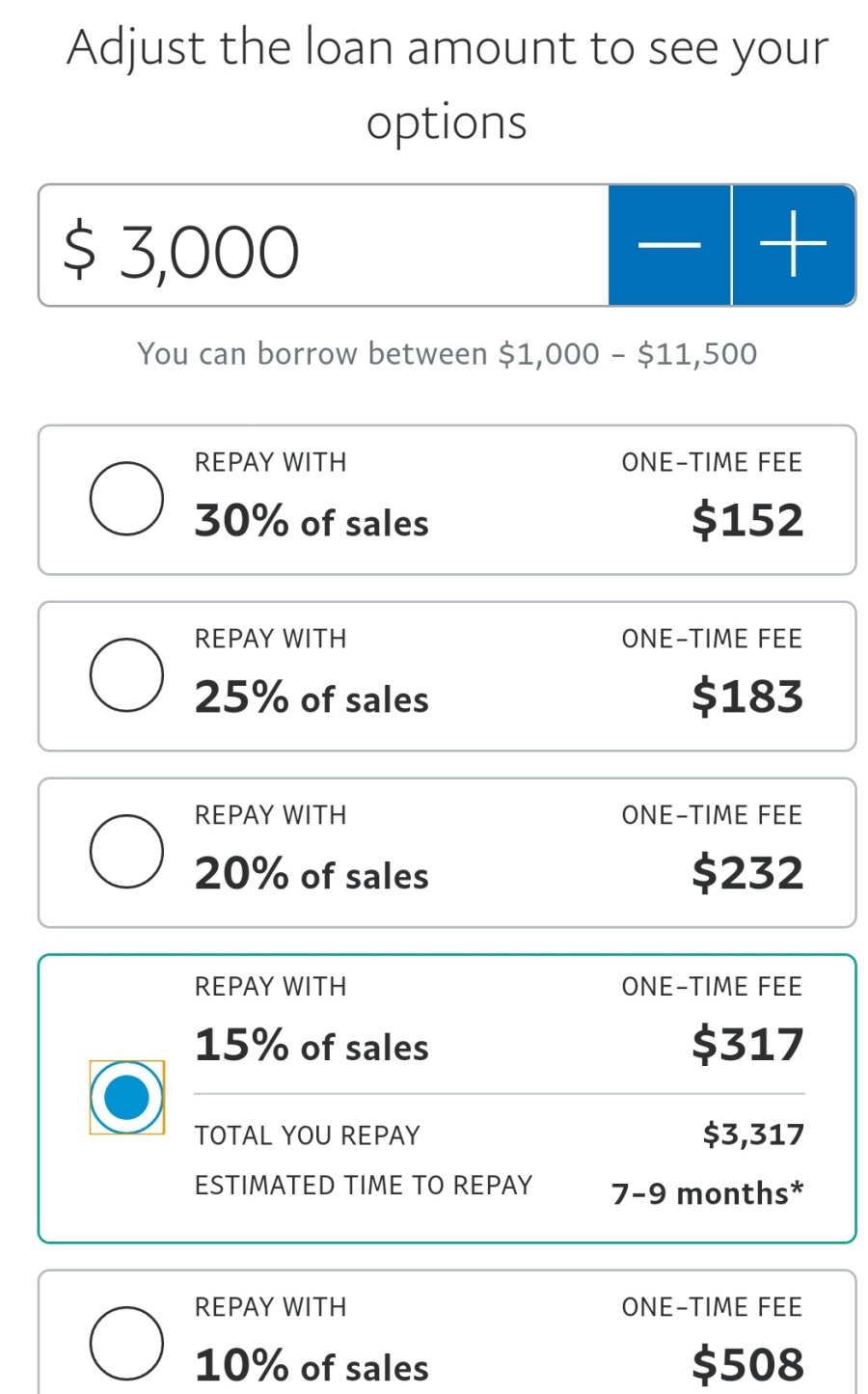

The structure of each of these loans are identical. The platform advances you sales, basically. They take a flat fee (Paypal $, Shopify %), and you pay back at a certain %. That’s it! Really? Ya! It’s that simple. Don’t complicate it. Don’t overthink it. I’ve ran the numbers for days. Not hours- DAYS! Trying to find some weird twist in it all. There isn’t one.

Paypal wins this race, because it allows you to play with the amount borrowed and look at the flat rate + % payback to choose your ideal setting. These numbers are balanced across the board- meaning, if you want to borrow an additional $1500, you’ll still pay the same % flat rate, it’ll just be more, of course. But it can look confusing, because Paypal lists theres in dollar amount versus %.

Shopify gives you a mere THREE options. (BOO!) There seems to be no rhyme or reason behind their offers. It clearly spells out the % fee + payback rate, but again, you only have three options to choose from. Take it or leave it.

Application

With Paypal, at any time, you may visit their siteand apply. Their approval happen instantly, and the process is so straight forward. You never have to guess at all, which is why most of us just close out that tab and forget about lending.

Shopify is basically a big fat surprise- or is it!? We got our first offer, not by random (like they say), but after researching about their capital loan options. (funny!) The options were confusing the first time around, and we didn’t understand the process very well. When would we be notified? What happened if we got turned down? When and how would we get the funds? They could use a new communications director in their Capital dept.

Approval

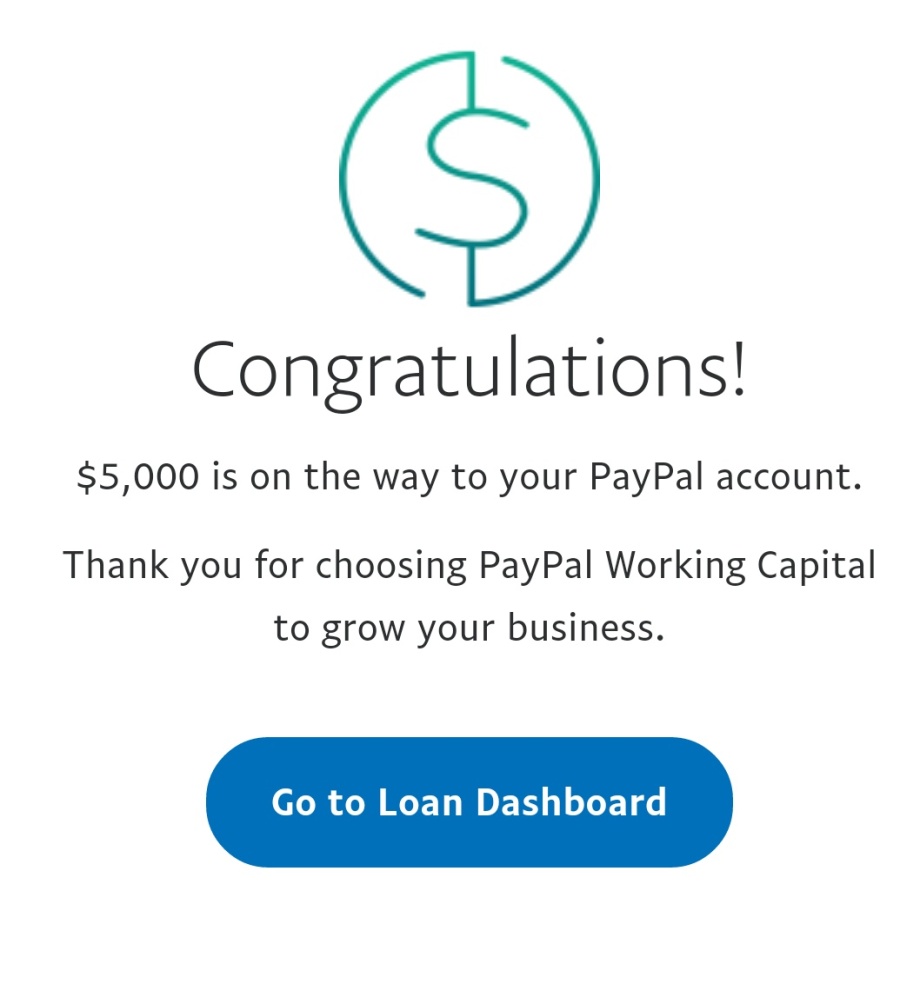

Paypal approves you immediately, and once you’ve chosen your ideal loan, the money is INSTANTLY in your PayPal account. Did you get that? Instantly.

If you are denied, they will e-mail you immediately either stating why, or promising an investigation with a mailed letter to follow.

Shopify “surprises” you with an offer. Once you choose your ideal loan, you play a waiting game in your inbox. Once you’re approved, it takes 1-4 business days to head to your bank account. There is no known information about a rejection, since they don’t have a formal application process, just a “surprise” offer.

Payments

Paypal creates an entire dashboard with clear charts stating your payback rate, recent payments, estimate time to completion, etc. You repay from your Paypal balance, and can even make extra payments when you desire.

Shopify gives you this:

With Shopify, the % you pay back comes daily from your bank account. If you are like the majority of Shopify users in the U.S., the bulk of your payments are actually processed through Paypal. This means a serious inconvenience of moving money from account to account and crossing fingers and toes nothing transfers faster than normal. Additionally, there is no additional payment option. The only option it gives you is to pay off the loan as a lump sum (which only comes after the first 30 days of repayment).

It’s likely clear which one we prefer. Shopify has some modifications due, and let’s all hope they receive the feedback well. We have personally had both loans, Shopify first, and Paypal is a dream come true.

As with all lending, please make wise decisions that benefit your business to the best of its abilities. Do not practice irresponsible habits or use these loans for personal reasons. That is said with love and compassion and wanting the best for your business.

Thanks to all brave BHUB members who allowed these photos & peek inside capital loans! We appreciate you & respect your privacy & cooperation.

Leave a comment